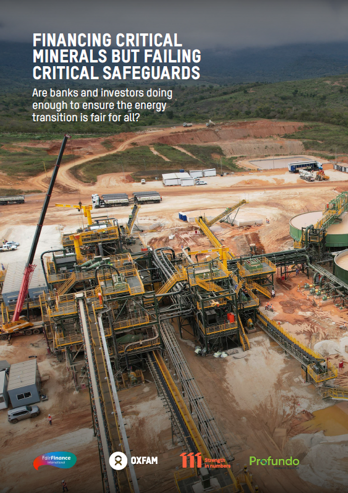

FFI Case Study: “Financing Critical Minerals but Failing Critical Safeguards”

European banks pour nearly €8 billion a year into critical minerals mining despite links to human rights and environmental abuses

Meanwhile, the EU rolls back and weakens its sustainability and green rules

New Oxfam, Fair Finance International and 11.11.11. report exposes how Europe’s banks and investors are blindly investing in mining companies linked to land grabs, pollution and human rights violations. This comes ahead of the EU’s Raw Materials Week.

The report, “Financing Critical Minerals but Failing Critical Safeguards”, finds that Europe’s drive to secure critical raw materials needed for the green transition inadvertently fuels human rights abuses and environmental harm. It highlights the financial and reputational risks for banks and investors, while exposing the hidden impact of the EU’s green agenda and the reality of the EU dismantling its sustainability rules.

Between 2016 and 2024, EU banks provided €64 billion in loans and underwriting services to mining companies extracting critical raw materials, including lithium, copper, nickel and cobalt; all essential for Europe’s clean energy future. EU investors hold €15 billion in bonds and shares in mining companies.

The report analyses the eight largest EU banks and investors on their environmental and human rights safeguards, including BNP Paribas, Crédit Agricole, Allianz, ING, and Banco Santander, giving scores ranging from just 2.6 to 4.0 out of 10.