Fair Finance Vietnam publishes English edition of third policy assessment of Vietnamese banks

Fair Finance Vietnam has launched the English version of its 3rd Bank Policy Assessment report, accompanied by a report summary.

In the third assessment of Vietnam, FFV used the FFG methodology toolkit updated in 2024. Eleven banks assessed in the second analysis carried out in 2022 were analyzed again with two more banks added to the analysis list; Asia Commercial Joint Stock Bank (ACB) and Southeast Asia Commercial Joint Stock Bank (SeABank). Data collected for analysis is published by the banks themselves on their websites and updated as of 31 November 2024.

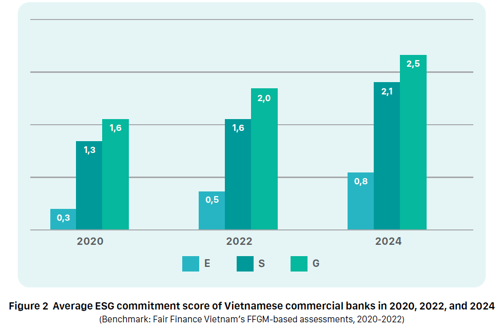

Eleven themes under three pillars Environmental – Social – Governance were selected for assessment, and it was found that ESG policy commitments of Vietnamese commercial banks in 2024 have improved since the previous assessments in 2022 and 2020. The average ESG score of Vietnamese commercial banks in the 2024 research sample was 2.0 out of 10 points, representing a 0.5 (33.3%) increase from 2022 and a significant 0.9 (81.8%) increase from 2020.

The improvement in ESG scores in this assessment, compared to previous ones, was observed across all three pillars: Environmental (E), Social (S), and Governance (G). However, among these three pillars, policy commitments primarily concentrate on the Social (S) and Governance (G) pillars, while those on the Environmental (E) pillar remain somewhat less defined.

Despite some positive progress, the 2024 analysis shows that Vietnamese commercial banks are still in the nascent stages of ESG policy commitments and implementation. Consistent with previous years, public ESG policy commitments primarily concentrate on the commercial banks’ internal operations and financing/investment policies. However, in 2024, some banks have begun to set out ESG policy for businesses receiving their loans.